Offering More Than Asking Price for Beginners

Table of ContentsGetting The Offering More Than Asking Price To WorkThe Best Guide To Offering More Than Asking PriceHow Offering More Than Asking Price can Save You Time, Stress, and Money.The Only Guide to Offering More Than Asking PriceThe Basic Principles Of Offering More Than Asking Price The 15-Second Trick For Offering More Than Asking Price

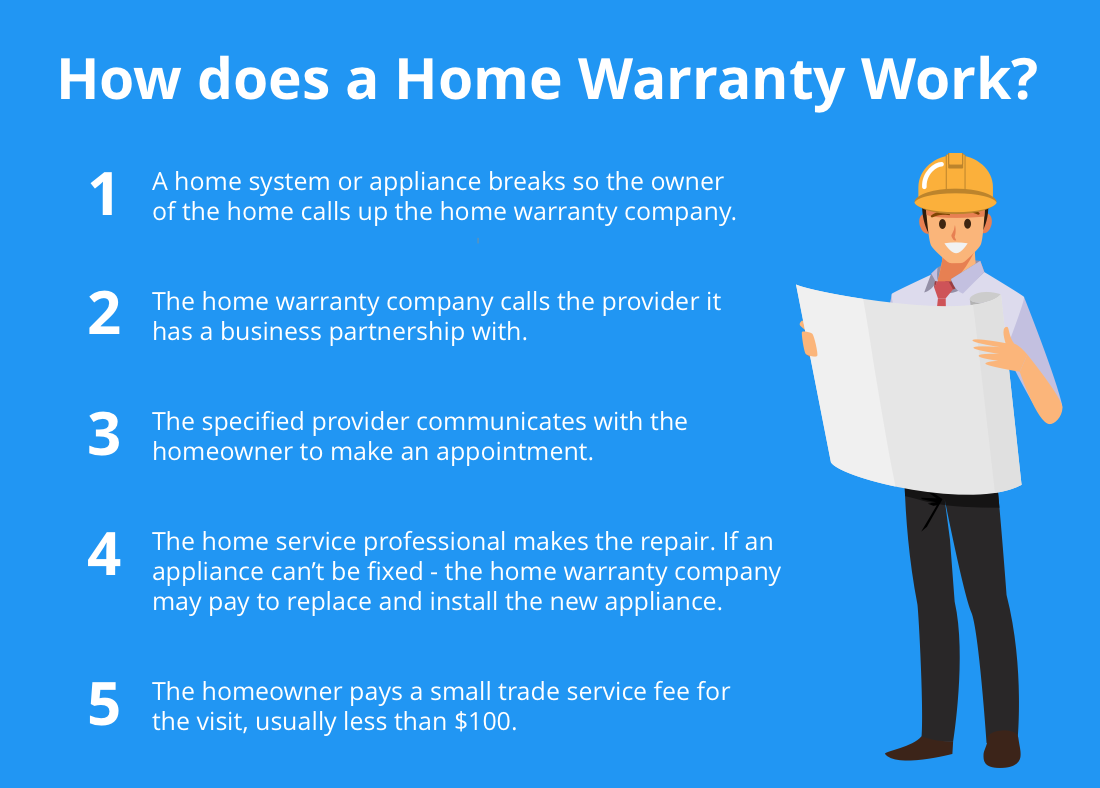

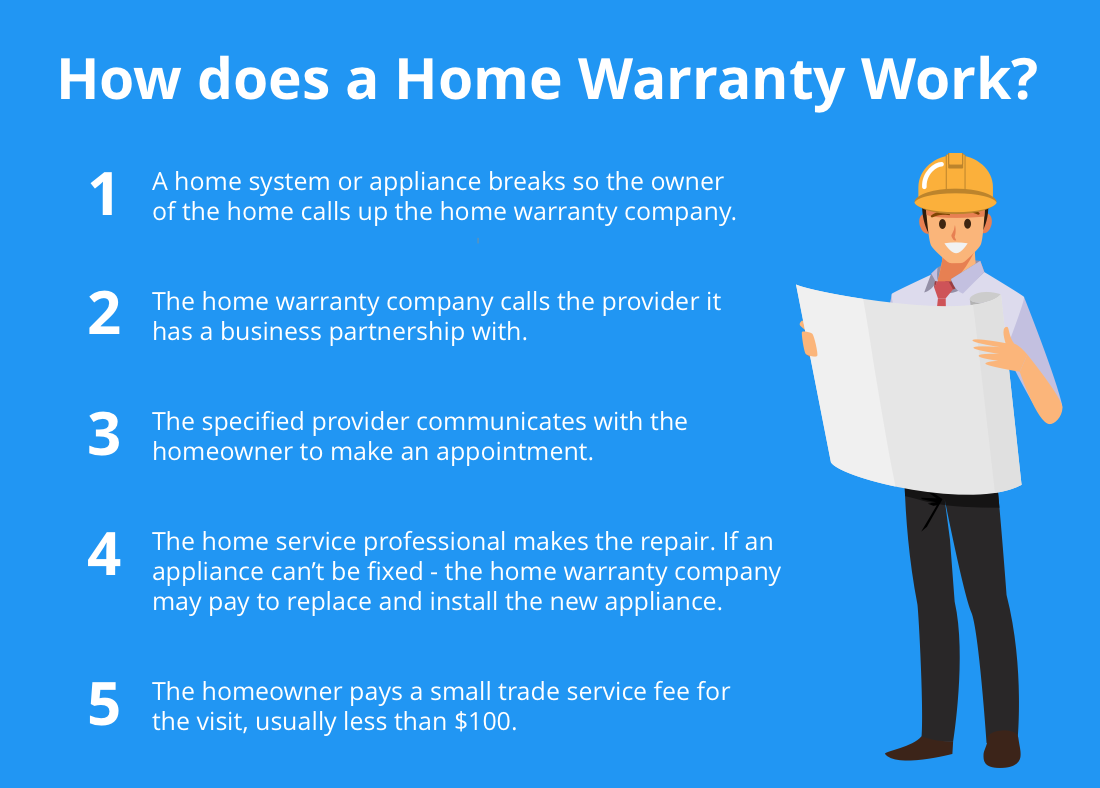

Have you ever wondered what the difference was between a residence warranty as well as home insurance policy? Do you require both a residence guarantee and also residence insurance policy, or can you get just one? A residence warranty secures a residence's inner systems and also appliances.

Top Guidelines Of Offering More Than Asking Price

What does a house guarantee cover? A home service warranty covers the primary systems in a home, such as a house's heating, air conditioning, plumbing, as well as electric systems. A residence guarantee may additionally cover the larger appliances in a residence like the dish washer, oven, refrigerator, clothing washer, and also clothes dryer. House warranty business normally have different strategies offered that supply coverage on all or a pick few of these things - offering more than asking price.

If a bathroom was leaking, the home guarantee business would certainly pay to fix the toilet, yet would not pay to fix any type of water damages that was created to the framework of the residence because of the leaking bathroom. If a home owner has a home mortgage on their home (which most homeowners do) they will be needed by their home mortgage lender to acquire residence insurance policy.

The 8-Second Trick For Offering More Than Asking Price

Residence insurance may likewise cover clinical expenditures for injuries that individuals suffered by getting on your home. A home owner pays a yearly premium to their house owner's insurer. Usually, this is somewhere between $300-$1,000 a year, depending upon the plan. When something is harmed by a calamity that is covered under the residence insurance coverage, a house owner will call their house insurer to sue.

House owners will normally have to pay a deductible, a fixed quantity of cash that appears of the house owner's budget before the home insurance provider pays any kind of cash in the direction of the insurance claim. A home insurance deductible can be anywhere in between $100 to $2,000. Usually, the greater the deductible, the lower the annual premium cost - offering more than asking price.

What is the Distinction In Between House Warranty and also House Insurance A home service warranty contract and a residence insurance coverage run in similar ways. Both have an annual costs and an insurance deductible, although a house insurance costs and also deductible is often much greater than a home service warranty's. The primary differences in between residence warranties and house insurance my response are what they this content cover.

Facts About Offering More Than Asking Price Revealed

An additional difference between a house warranty as well as house insurance policy is that home insurance coverage is usually required for property owners (if they have a home mortgage on their residence) while a home guarantee plan is not needed. A residence service warranty and home insurance coverage supply defense on different parts of a home, as well as with each other they can shield a property owner's budget plan from costly fixings when they unavoidably emerge.

They will collaborate to give protection on every part of your home. If you're interested in purchasing a home warranty for your house, take a look at Landmark's house warranty strategies and rates below, or demand a quote for your residence below.

Some Known Details About Offering More Than Asking Price

"Nonetheless, the much more systems you add, such as pool insurance coverage or an extra heating unit, the higher the cost," she claims. Includes Meenan: "Prices are often negotiable also." In addition to the yearly fee, house owners can anticipate to pay typically $100 to $200 per service call browse through, depending upon the kind of agreement you purchase, Zwicker notes.

House service warranties don't cover "products like pre-existing problems, animal invasions, or remembered products, discusses Larson."If individuals do not read or comprehend the insurance coverages, they may end up thinking they have insurance coverage for something they don't.

"We paid $500 to sign up, and after that had to pay one more $300 to cleanse the main sewer line after a shower drain back-up," claims the Sanchezes. With $800 out of pocket, they thought: "We didn't take advantage of the residence guarantee in all." As a young pair in one more home, the Sanchezes had a challenging experience with a home warranty.

The Greatest Guide To Offering More Than Asking Price

When the professional had not been pleased with a reading he got while testing the furnace, they say, the firm would certainly not consent to protection unless they paid to replace a $400 part, which they did. While this was the Sanchezes experience years earlier, Brown validated official source that "checking every major appliance prior to giving insurance coverage is not a sector requirement."Always ask your service provider for clarity.